What Happens If You Don’t File Your Taxes? (And What to Do If You’re Behind)

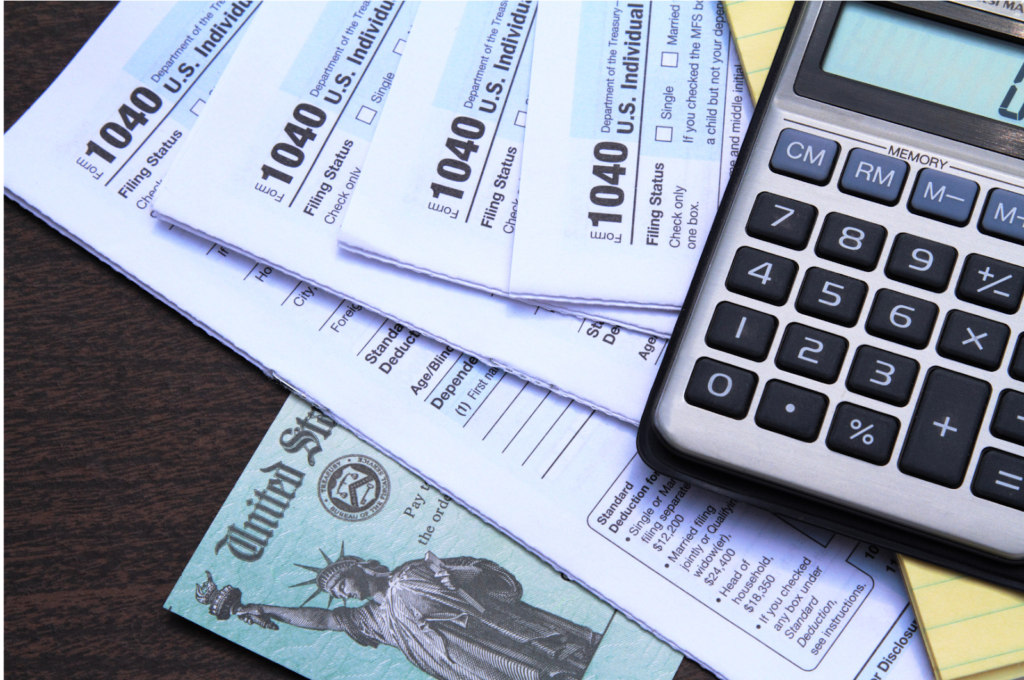

As we inch closer to the April 15 tax deadline, a lot of people are feeling that familiar pressure — digging through files, stressing over numbers, and maybe even procrastinating a little more than they should. Sound familiar? If you’ve found yourself thinking, “What if I just skip it this year?” — take a deep […]

What Happens If You Don’t File Your Taxes? (And What to Do If You’re Behind) Read More »